2024 CPP Changes

This year we’ve got some big changes to the Canada Pension Plan that many Canadians will notice.

Here’s a rundown of what you need to know about the CPP Changes in Canada for 2024.

Fundamentals of CPP

First up let’s do a quick review of the Canada Pension Plan basics.

What is CPP and Why Does it Come off My Paycheque?

A pretty important question to answer is what the heck is CPP and why does it get deducted from your paycheque.

The CPP is a mandatory pension plan for almost all workers in Canada.

If you're over 18, working in Canada outside of Quebec, and earning more than $3,500 a year, part of your paycheck goes into the CPP.

However, it’s not just a deduction; it ends up making up part of your future financial safety net. And it's a joint effort between you and your employer.

A portion of your salary is contributed to the CPP, and your employer matches that contribution. So, for every dollar you put into the CPP, your employer is adding another dollar.

CPP is Not a Tax

But to be clear, the CPP isn't a tax. It's a contribution towards your own retirement fund. Think of it as a long-term savings plan that the government manages for you.

The idea is that when you retire, you'll receive a pension based on how much you and your employer have contributed over the years.

So, while it might sting a little to see those deductions now, remember, this is for your financial security down the road. It's ensuring that you have a stable income when you decide to hang up your work boots or your extensive collection of name tags and hair nets.

That's the CPP in a nutshell – a mandatory, employer-matched retirement plan.

Now, let's move on to the new stuff – the changes coming in 2024

CPP Changes in 2024

There are some pretty significant changes coming about for the Canada Pension Plan in 2024.

Two Tier System and New Thresholds

The most notable change being the introduction of a new two-tier system. This is a big deal because it changes how much you'll contribute based on your earnings.

Let's break down what this means.

Starting in 2024, there will be two tiers of contributions.

The first tier is similar to how it worked in 2023; contributions are based on your income up to a certain limit.

But the second tier is where things get interesting. It introduces additional contributions for those earning above a certain threshold.

The first tier, or the Year's Maximum Pensionable Earnings or YMPE, will increase to $68,500.

This is up from $66,600 in 2023. What this means is that you'll contribute to the CPP on earnings up to this new, higher limit.

The second tier is known as the Year's Additional Maximum Pensionable Earnings or YAMPE. The second tier limit is set at $73,200.

Within this tier, your earnings between $68,500 and $73,200 will be subject to additional CPP contributions at a rate of 4%.

Calculating CPP Contributions

Calculating your CPP contributions can be a bit tricky, but it's important to understand.

The first $3,500 that you earn are exempt from CPP, meaning no CPP is calculated on your earnings up to that amount.

For your earnings above $3,500 and up to $68,500, you and your employer will each contribute 5.95% in 2024.

For earnings between $68,500 and $73,200 the contribution rate is an additional 4% from both you and your employer.

CPP calculations for 2024 look like this 👇

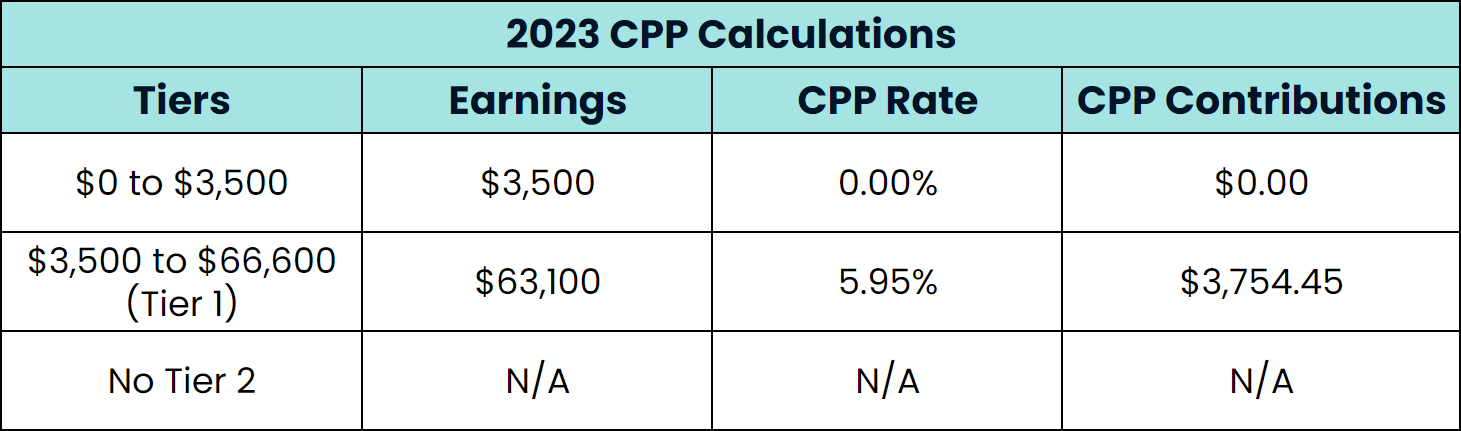

Which is a pretty significant change compared to 2023 where there was only a single tier with a lower maximum pensionable earnings amount of only $66,600 instead of $68,500 for 2024.

CPP Calculations for 2023 looked like this 👇

Impact on Different Income Levels

These changes will impact Canadians differently based on their income levels. For those earning under the YMPE, meaning less than $68,500, the impact will be minimal.

However, for those earning more than the YMPE, you'll notice a pretty pronounced increase to your CPP contribution this year.

Example 1 - Employee Earning $60,000

Let’s start with an easy example, an employee earning $60,000.

To start with, the basic exemption is $3,500 so no CPP is calculated on the first $3,500 of income.

So then the remaining amount of $56,500 is multiplied by the CPP contribution rate of 5.95% in both 2023 and 2024.

For both years, then, we get a total CPP contribution of just under $3,362.

No change in CPP contributions for the employee earning $60k.

Example 2 - Employee Earning $68,000

Next let's look at an employee earning $68,000 in 2023. This person would have contributed a total of $3,754 which was the maximum for that year.

If they earned the same amount in 2024, their CPP contribution would increase only moderately to just under $3,838.

This is an increase of around $84.

Example 3 - Employee Earning $75,000

For the third example, we’ll look at an employee who would fall into the second tier of CPP which is anyone earning more than $68,500.

If our second employee earned $75,000 in 2023 they would still only contribute $3,754 which was the maximum for that year.

However, if they earn $75,000 in 2024, their total contribution would increase to $4,055 due to the increased YMPE and addition of the second tier, or YAMPE.

So if you earn an income above $73,000, you’ll pay about $300 more in CPP contributions this year compared to 2023.

CPP and Self-Employed People

For the self-employed, these changes are particularly significant. Since self-employed individuals contribute both the employee and employer portions, the increase in contribution rates means a bigger chunk of their income goes towards CPP.

Their maximum contribution goes from around $7,500 in 2023 to just over $8,100 in 2024.

If you’re self-employed, that’s a big chunk of your earnings that doesn’t stay with you at the end of the year.

Why the Changes to CPP in 2024?

The 2024 changes to the CPP are designed to bolster the pension plan for future generations.

While it means higher contributions now, the goal is to ensure a more secure retirement for all Canadians.

Financial Literacy is Important

These CPP changes underscore the importance of financial literacy, particularly for the self-employed and entrepreneurs. Understanding these nuances can make a big difference in your financial planning.

YouTube Live Workshops

Keep an eye on Avalon's YouTube Channel for our live workshops that we hold twice per month.

We discuss timely financial topics for small business owners, self-employed individuals and general, tax paying Canadians

Online Courses

We also offer online courses where we cover topics from bookkeeping and tax filing to launching a successful business.

Check out Avalon's courses page for more information.

%20(8).png)

%20(7).png)